Abstract

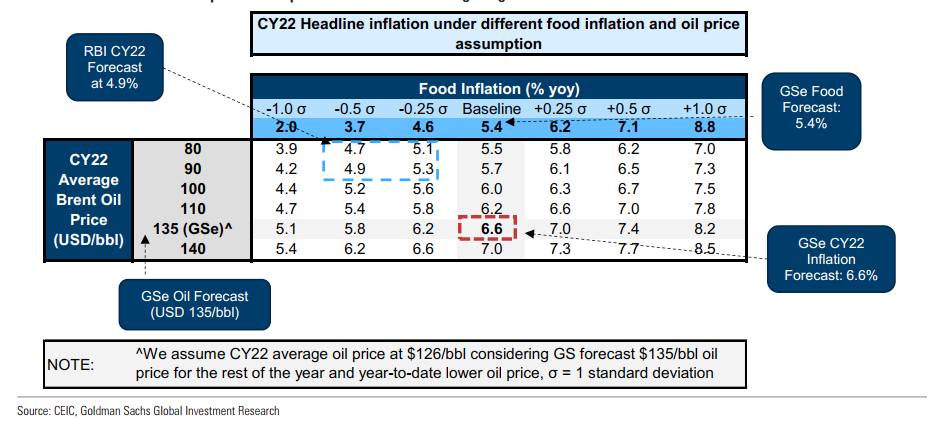

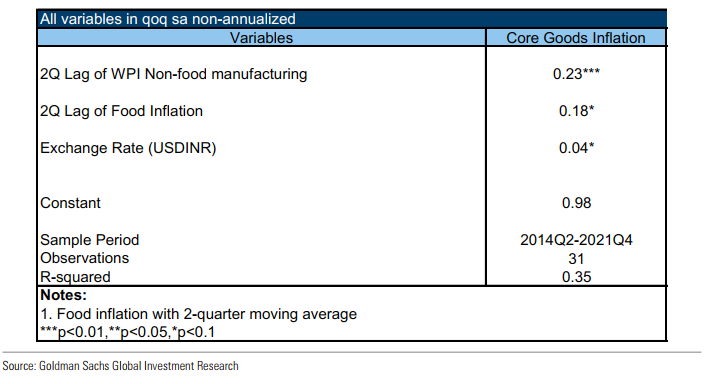

India’s core CPI inflation has increased considerably to 6% yoy despite a negative output gap, driven by core goods inflation increasing to 7% yoy (from below 3% before the pandemic). Rising global commodity prices and supply chain bottlenecks fed into goods inflation even as core services remained range-bound around 4 - 5%. In addition, a further recent surge in commodity prices due to supply shortages exacerbated by potential supply chain disruptions following Russia’s invasion of Ukraine and the ensuing sanctions on Russian entities, has added to significant upside inflation risks in 2022.With our commodities team now forecasting an extended period of elevated prices(Brent crude at $135/bbl for 2022), we have increased our headline CPI inflation forecast for 2022 by 90bp to 6.6% yoy, above the 2%-6% RBI target band.

Figure 1: Food and Brent oil price assumptions have to remain benign to get close to the RBI’s headline inflation forecast in 2022

Figure 2: WPI Non-Food manufacturing is significant driver of core goods inflation

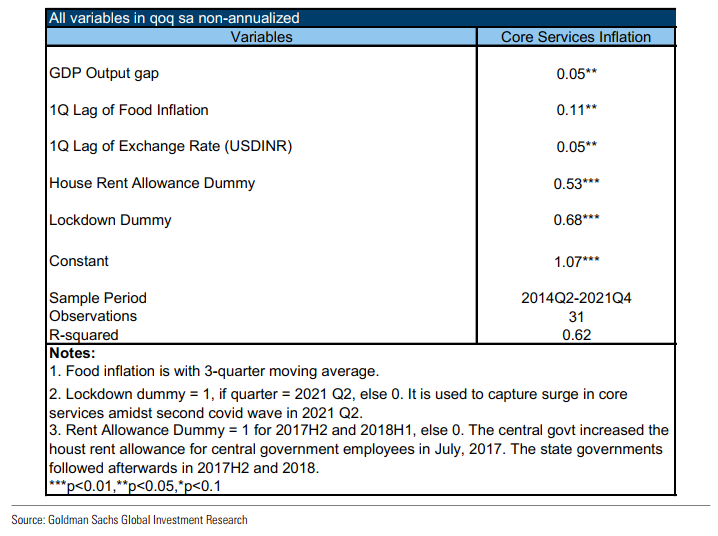

Figure 3: Core services inflation driven by output gap, food inflation and exchange rate

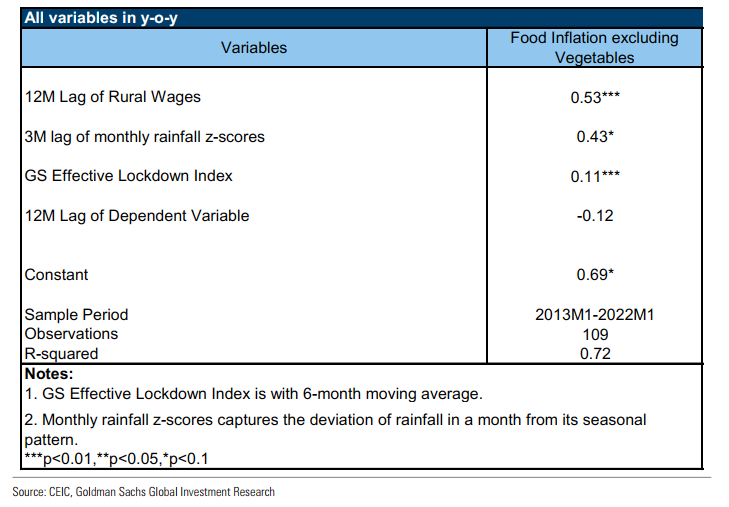

Figure 4: Food inflation is driven by lagged changes of rural wages and inflation

Article available on request