Abstract

Exports have played a crucial—but often under-appreciated—role in India’s growth dynamics over the last two decades. High GDP growth during the pre-GFC period was in part driven by an export surge, and resulted in exports as a share of GDP rapidly increasing from 13% in 2000 to 22% in 2006. Conversely, as exports growth fell over the last decade, India’s external trade as a share of GDP stagnated, and India’s share in global and EM exports declined. This stagnation coincided with a global growth slowdown, and a stronger currency (INR) on a real effective exchange rate (REER) basis, which have been the primary drivers of the export slowdown, in our view. A stronger REER has especially hurt manufacturing exports, and has policy implications at a time when India is trying to promote manufacturing export growth. We also find that while domestic demand drives overall imports growth, negative real rates are an important driver of gold imports. Gold imports have been running at an all-time high in 2021, while real rates are negative given accommodative monetary policy (the same was true before the ‘taper tantrum’).

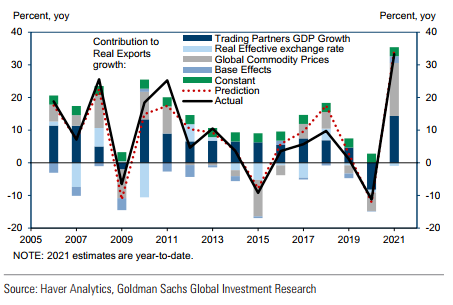

Figure 1: Exports growth in 2021 is mainly driven by trading partners growth and commodity prices

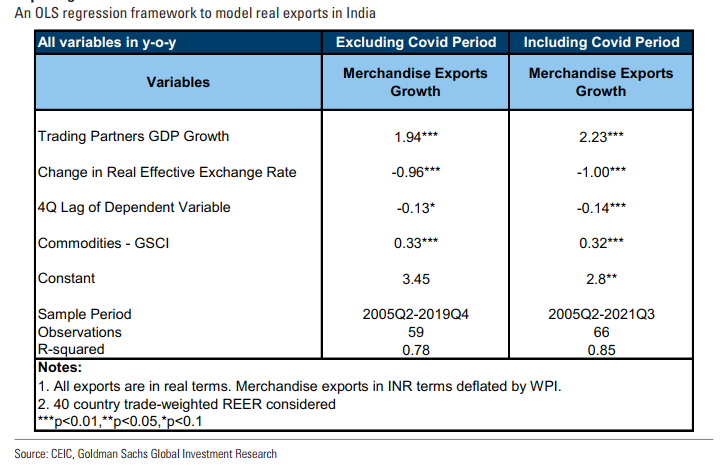

Figure 2: Trading partners GDP growth and real effective exchange rate are important determinants of exports growth

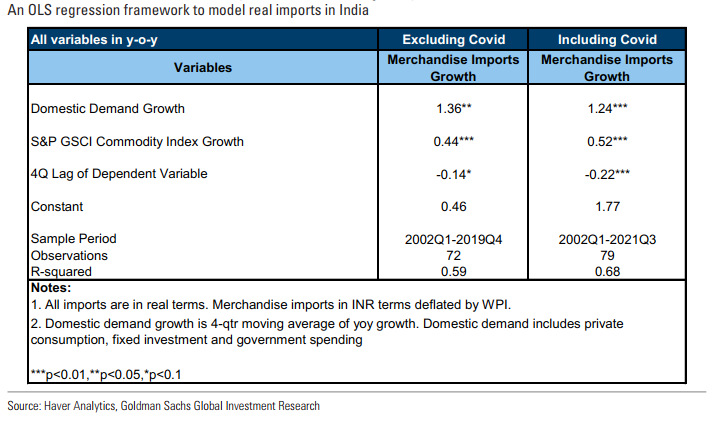

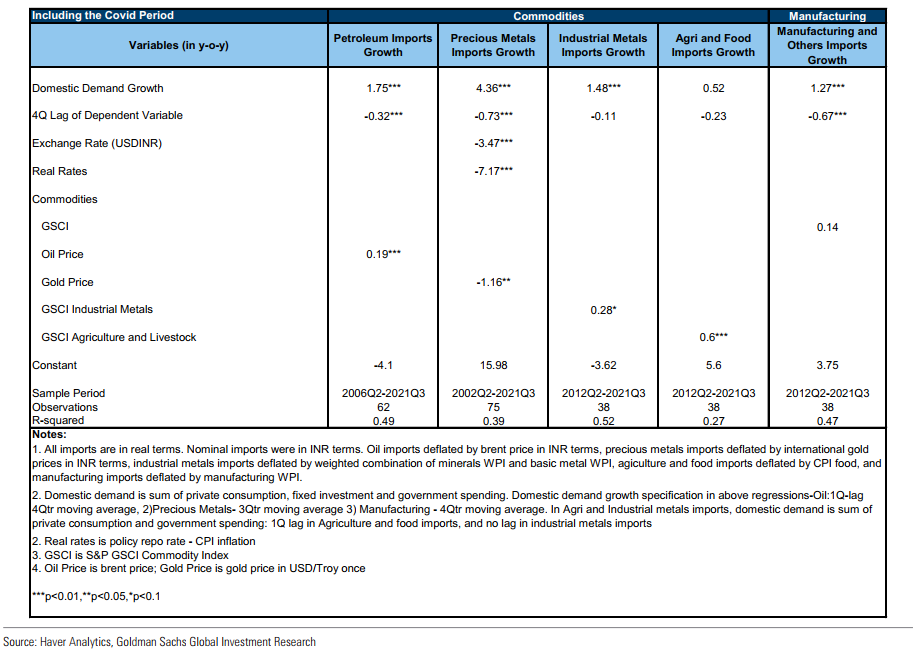

Figure 3: Domestic demand is a significant driver of imports growth

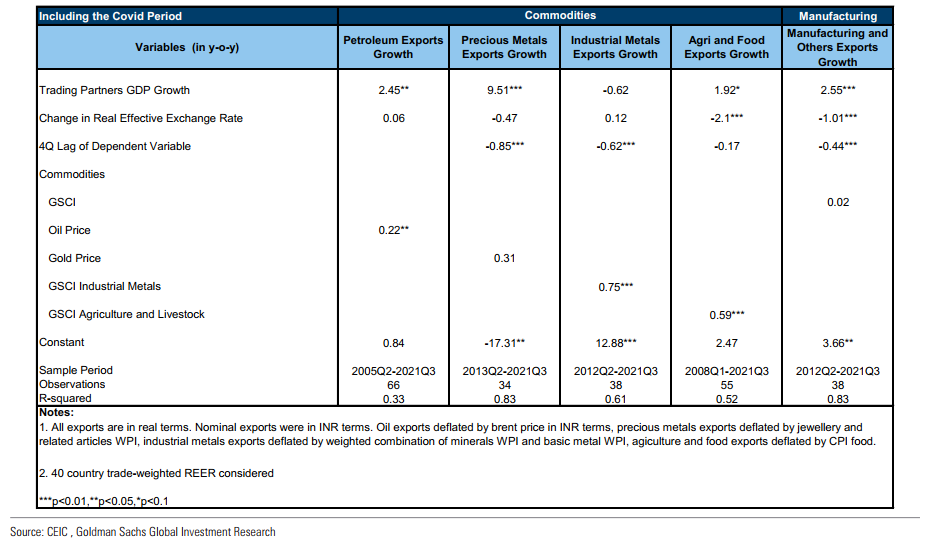

Figure 4: Trading partners GDP growth and real effective exchange rate drive exports growth in most components

Figure 5: Precious metals imports growth is most elastic to changes in domestic demand growth

Article available on request