Abstract

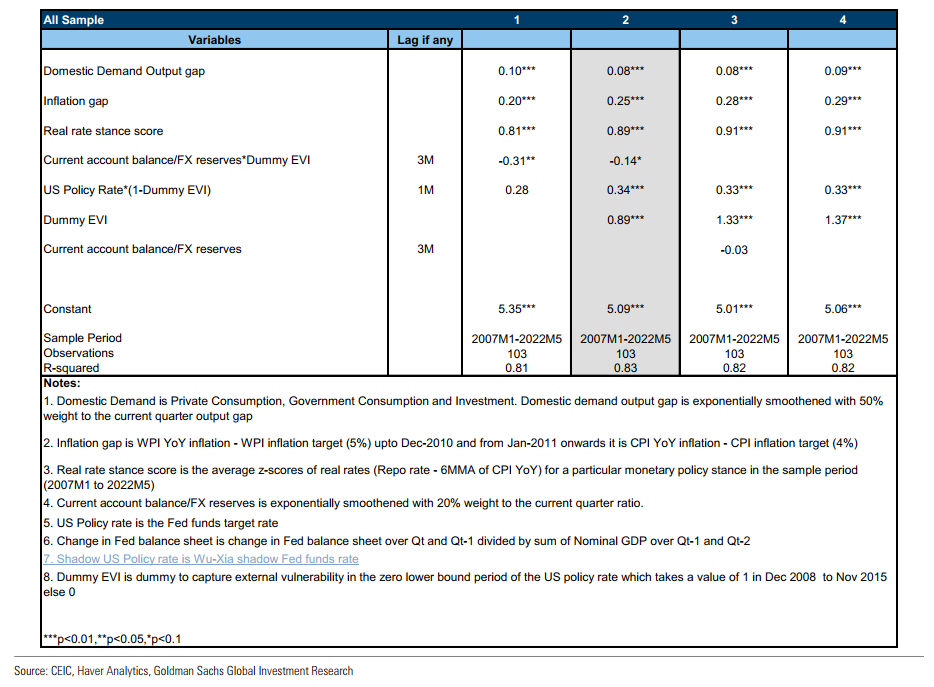

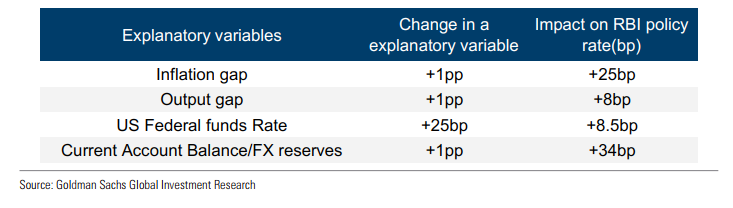

We model the RBI’s reaction function over the past fifteen years to assess the direction and magnitude of monetary policy. We find that the output gap,inflation gap, US policy rate, and external vulnerability explain over 80% of the changes in policy repo rates. Our model also attempts to capture the ‘real rate stance’ of different RBI Governors (or MPCs in the flexible inflation targeting regime, or FIT) and the apparent differences in their reaction functions across macro and institutional regimes. We also estimate that RBI responds more to the inflation gap than the output gap, especially post the adoption flexible inflation targeting framework

Figure 1: Output gap, inflation gap, external balances and US policy rates play a significant role in setting Indian policy rates

Figure 2: Sensitivity of RBI policy rate to different variables

Article available on request